Archive for the ‘Comanche Peak’ Category

Judge clears Energy Future to move ahead on selling Oncor to Hunts

September 17, 2015

James Osborne

Dallas Morning News

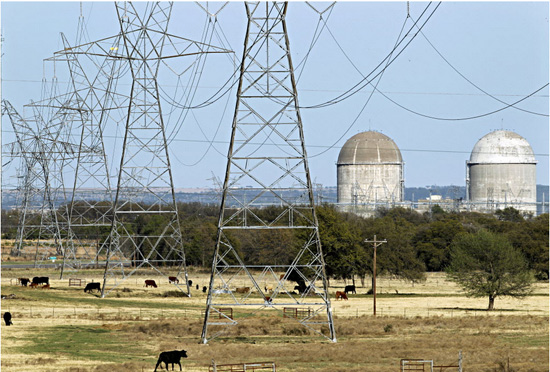

Transmission lines lead to Luminant’s Comanche Peak Nuclear Power Plant near Glen Rose, Texas. (Tom Fox/The Dallas Morning News)

WILMINGTON, Del. — Almost 18 months after filing for bankruptcy, Texas’ largest power operator Energy Future Holdings was cleared Thursday to move ahead on its plan to break up the company and settle its $40 billion in debts.

With hopes of getting out of court by spring, Energy Future plans to hand its power plants and the retail business TXU Energy to senior creditors, while the transmission business Oncor will be sold to a group led by Dallas billionaire Ray L. Hunt.

It was a quiet conclusion to what had the makings of a potentially high-stakes showdown between Energy Future and an aggressive group of creditors arguing the current restructuring plan is unlikely to succeed. By the time teams of dark-suited attorneys made their way into court Thursday morning though, the two sides had agreed to a temporary truce.

Smaller disagreements would be put aside, leaving the larger question of whether Energy Future was fairly paying off its creditors with what assets it has left to a trial in November.

"We’re happy to cede the battleground today," said Andrew Dietderich, an attorney representing the opposing creditors group. "Our objection is stronger than ever."

The case marks the inglorious end to what remains the largest leveraged buyout in U.S. history. Led by private equity tycoons Henry Kravis and David Bonderman, in 2007 the shareholders of TXU Corp., which served millions of customers across Texas, agreed to sell the company for $45 billion.

But saddled with so much debt, the company quickly fell into financial trouble when natural gas prices — which set the price of electricity in Texas — started to fall, as hydraulic fracturing operations across Texas and Pennsylvania flooded the marketplace with gas.

The entrance to the U.S. Bankruptcy Court in Wilmington, Del. (James Osborne/Staff Writer)

Now every couple weeks attorneys from New York and Dallas file up to the fifth floor of a nondescript red brick building in downtown Wilmington to argue over what’s left of what had been one of Texas’ oldest and most recognizable companies.

One of the busiest courts in the country for corporate bankruptcies, the Delaware district has become like a second home to those who operate in the arcane but lucrative field. Sitting shoulder to shoulder on dark-wooden benches Thursday, attorneys racking up hundreds if not thousands of dollars for the appearance speculated on the day’s developments.

"If everything goes right it could be be done by April, but I don’t know," said Harold Kaplan, a Chicago-based attorney. "Everyone’s still doing staring contests."

The question is whether the deal to sell Oncor, which serves more than 3 million customers across North and West Texas, will go through. Hunt and his partners want to place the power line company into what is termed a real estate investment trust, essentially a means to shift income tax liability from the company to its shareholders.

Only a utility on the scale of Oncor has never been operated under such a structure, tax experts say.

Hunt and his son Hunter, who helps run Hunt Consolidated and launched the power line business Sharyland Utilities in 1999, are counting on Oncor generating enough income to support a purchase price valued between $18 and $19 billion. But first they will need to persuade the Texas Public Utility Commission, which sets rates for the transmission and distribution of electricity.

An application for the takeover of Oncor will be filed within the next two weeks, an attorney representing the Hunt consortium said Thursday.

The fate of Energy Future hinges on the Hunts getting a favorable ruling from the PUC. Without it, the deal would likely collapse and the company and its creditors would have to regroup next year and find an alternative strategy.

"We wanted to stay away from settlement issues. Those are matters for another day, namely Nov. 3 and thereafter," said Marc Kieselstein, an attorney representing Energy Future.

The day was not entirely absent of conflict.

The Office of the U.S. Trustee, which acts as an administrator in federal bankruptcy cases, joined forces with a small creditors group to argue that it was too early for the company to start sending out ballots for creditors to vote on the restructuring plan.

An actual investor in Energy Future – standing out in his sport coat and hiking shoes – took to the podium to say the proposal "doesn’t seem fair."

But Sontchi had seen enough. After closing in on 18 months of hearings and more than 6,000 court filings, he signaled to the attorneys gathered before him it was time to move towards an end.

"A transaction doesn’t have to close, but the possibility of close-ability in a timely fashion – yes, I used the word close-ability – requires action be taken now," he said.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

CB&I to cut more than 300 jobs after contract ends

Apr 28, 2015

Olivia Pulsinelli

Houston Business Journal

Mike Fuentes/Bloomberg News

Dallas-based Luminant told CB&I Stone & Webster Inc. last week that it would discontinue the teaming agreement the companies have for the Comanche Peak Nuclear Power Plant in Glen Rose, Texas. CB&I will cut 322 jobs at that location.

The Netherlands-based Chicago Bridge & Iron Company NV (NYSE: CBI), which has its operational headquarters in The Woodlands, will cut 322 jobs in Texas, according to a letter to the Texas Workforce Commission.

Dallas-based Luminant told CB&I Stone & Webster Inc. last week that it would discontinue the teaming agreement the companies have for Luminant’s Comanche Peak Nuclear Power Plant. The plant is in Glen Rose, about 55 miles southwest of Fort Worth.

Luminant has asked CB&I Stone & Webster to assist with transition services through May 31, which is when CB&I expects to terminate the positions. Stone & Webster, which was founded in 1889, became part of The Shaw Group in 2000. CB&I acquired Shaw in 2013.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

NRC increases oversight of Comanche Peak nuclear power plant

April 29, 2015

Source: U.S. Nuclear Regulatory Commission

Via PennEnergy

NRC finalizes security-related inspection finding for Comanche Peak nuclear power plant, resulting in additional oversight

The Nuclear Regulatory Commission (NRC) will increase its level of oversight at the Comanche Peak nuclear power plant following the finalization of a security-related inspection finding classified as "greater than green." Luminant Generation Co. owns the plant, which has two operating reactors and is located near Glen Rose, Texas.

The NRC uses a color-coded assessment system for inspection findings and performance indicators, with colors ranging from green, for very low safety or security significance, to white, yellow or red, connoting high safety or security significance. In the case of security-related inspection findings or performance indicators, the NRC notifies the public when the "greater than green" threshold has been crossed. However, the agency does not provide specifics because of the sensitive nature of the information associated with such findings and indicators.

NRC inspectors identified the finding during a security baseline inspection at the Comanche Peak plant that concluded on January 26, 2015. On April 2, Luminant Generation Company provided the NRC a letter that described the reason for the violation and the corrective actions taken. The finding was documented in an inspection report issued on March 6, 2015.

After considering the information presented by the company, and the information developed during the inspection, the NRC has determined the finding is appropriately characterized as "greater than green."

"The NRC will determine the most appropriate response with respect to inspection and follow-up reviews, based on the significance of the finding," NRC Region IV Administrator Marc Dapas said. "It should be noted that the plant remains secure. Before our inspectors left the site, we ensured that appropriate compensatory measures were implemented."

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Comanche Peak Nuclear Plant Expansion Shelved

Mon, Nov 11 2013

Nuclear Street News

As Mitsubishi Heavy Industries turns its focus to restarting nuclear plants in Japan, the maker of the APWR and utility Luminant have shelved plans to build new reactors in Texas.

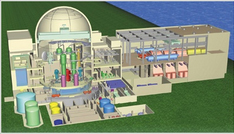

APWR rendering. Source: NRCIn 2008, Luminant applied for a combined license to add two reactors to the Comanche Peak nuclear plant near Fort Worth. According to the Nuclear Regulatory Commission, the project had been issued a final environmental impact statement, and a decision on the license was tentatively scheduled for 2015.

The NRC is also considering a license for the APWR design, but on Friday the Dallas Morning News reported that MHI would "slow the development of their design control document by several years.” Consequently, Luminant will suspend its COL application, although the company is not withdrawing it entirely. A Luminant statement quoted by the Morning News also noted that the utility “understand(s) the current economic reality of low Texas power prices driven in large part by the boom in natural gas."

The 1,620 megawatt APWRs would join two other pressurized water reactors at the site licensed in the early 1990s.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

EFH bankruptcy delayed

Impact on Comanche Peak, Somervell County remains unclear

Wednesday, November 6, 2013

AMANDA KIMBLE

The Glenrose Reporter

Nov. 1 came and went, and Energy Future Holdings (EFH) did not file bankruptcy. The parent company of Luminant Energy, which operates Comanche Peak Nuclear Power Plant, carries about $40 billion in debt.

As the Nov. 1 deadline to make a $270 million interest approached, experts across the nation began speculating about the company’s future. Locally, Somervell County Commissioners Court held a special meeting, informing employees EHT could expedite the looming Chapter 11 bankruptcy and file the debt restructuring plan rather than make the payment.

Media outlets across the nation, including Bloomberg News, Reuters and The Wall Street Journal reported hours before the deadline the Dallas-based electricity giant would make the scheduled payment.

"As I understand it, discussions with secured creditors have failed," County Judge Mike Ford explained, adding the failure reset debt negotiations. "They are not declaring bankruptcy at this point."

The next payment is due by late February or early March 2014.

While county officials and stock market analysts agree bankruptcy is inevitable, those at home in Somervell are saying while the filing could have a local impact, there is no fear the county’s No. 1 source of tax revenue will go off the grid.

"Closure of Comanche Peak is not what we are talking about," County Auditor Brian Watts said.

Ford agreed.

"The public needs to understand, no matter what happens, the power plant will not shut down," he said. "It is a part of the power grid."

But Watts said there could be an impact to the county.

"There are real fears about when the property tax payment will be made," he said.

And there are a lot of zeros attached to those fears. This year, Luminant’s tax payment is scheduled to bring about $8.8 million to county coffers. The current county budget adds up to more than $12 million, and there is $6 million in reserves.

During negotiations over Comanche Peak’s pending tax payment, the facility was devalued by more than $300 million this year. And officials say there is a real possibility the value will continue to decrease, causing the county to tighten its belt even more. It has also been said if the power plant is sold, the value would likely be less than what is currently on the books.

But Watts said as the county waits to see if the current year’s tax payment will be made, officials realize the ongoing negotiation process is not unprecedented.

"EFH is following what was started by General Motors," he said, referring to pre-negotiated bankruptcy filing.

Watts said the process will allow EHT to "shed bad assets and go forward with good decisions."

"Then they will be able to emerge out of bankruptcy and proceed," Watts said. "It may take awhile, but the secured creditors will get what’s due to them."

EHT was formed from one of the largest leverage buyouts in history – the $45 billion buyout of TXU Corp. in 2007. Watts said investors gambled on the fact that electricity rates – driven by natural gas prices – would remain high.

"They assumed gas prices would remain stable and possibly increase," Watts said, adding when fracking unveiled a wealth of natural gas across the nation, prices plummeted. While it was initially assumed to be a good deal in 2007, it became a bad business move, impacting big power players like Warren Buffet and Berkshire Hawthaway.

But at the end of the day, county officials have only one concern.

"I don’t care about Buffett and Wall Street," Watts said. "I care about Somevell County."

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.