Archive for the ‘Comanche Peak’ Category

Comanche Peak expansion suspended

Nov. 08, 2013

BY JIM FUQUAY jfuquay(at)star-telegram.com

Fort Worth Star-Telegram

Dallas-based Luminant Generation has told federal regulators that it will suspend its quest for a license to expand its Comanche Peak nuclear plant in Glen Rose, southwest of Fort Worth.

Luminant, in a letter to the U.S. Nuclear Regulatory Commission, cited a recent decision by its reactor partner, Mitsubishi Heavy Industries, to focus its efforts on restoring nuclear power in Japan, where reactors were idled after the 2011 earthquake and tsunami and Fukushima accident. That will slow Mitsubishi’s work to gain U.S. certification of the new reactor design that was to be used at Comanche Peak.

"As a result, Luminant is suspending work" on adding two new reactors to Comanche Peak "because of its reliance on the design certification," Luminant said in a prepared statement.

The plant currently has two reactors, and Luminant in 2006 announced plans to add two more. After gaining several steps toward obtaining a license for the plant from the NRC, work on the Comanche Peak project stalled as Luminant’s corporate parent, Energy Future Holdings, flirted with bankruptcy and as wholesale power prices in Texas remained low.

"Both MHI and Luminant understand the current economic reality of low Texas power prices driven in large part by the boom in natural gas," Luminant spokesman Brad Watson saud in a prepared release. "Luminant will continue to support nuclear power as part of the solution to Texas electric reliability and will re-evaluate this decision as conditions change," Watson said.

Two Texas opponents of the Comanche Peak expansion said Friday that Luminant’s suspension "shows that the so-called nuclear renaissance has fizzled."

Karen Hadden, executive director of the Sustainable Energy and Economic Development (SEED) Coalition, said the delay "clears the way for safer, cleaner and more affordable renewable energy in Texas."

Tom "Smitty" Smith, director of Public Citizen’s Texas office, said, "It was long believed EFH was keeping these licenses alive because they would be valuable assets in bankruptcy. This stunning decision shows how little bankers on Wall Street value nuclear power."

The letter to the NRC, dated Thursday, said that "while Luminant preferred for MHI to continue" to pursue certification of its reactor, "that alternative does not appear viable given MHI’s other priorities."

The letter goes on to say that Luminant "concluded that it does not make sense to continue to expend Luminant or NRC resources" on the work toward a new license.

Jim Fuquay, 817-390-7552 Twitter: @jimfuquay

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Comanche Peak’s declining value proves costly for once-flush Somervell County

Oct. 08, 2013

By Bill Hanna

billhanna(at)star-telegram.com

Fort Worth Star-Telegram

GLEN ROSE — Unlike many rural areas in Texas where residents and revenue have steadily declined in recent years, Somervell County has prospered.

The little county tucked next to Hood and Johnson has more than doubled its population since 1980, to roughly 8,800 residents, and boasts several tourist attractions, such as the Dinosaur Valley State Park and Fossil Rim Wildlife Center.

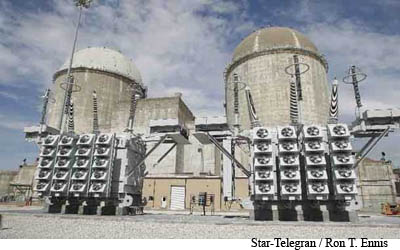

Perhaps the county’s best-known landmark is the Comanche Peak Nuclear Power Plant, which produces enough electricity annually to power 1.15 million homes — and has provided tens of millions of dollars in property taxes to Somervell’s coffers, a seemingly endless bounty of municipal gold.

As the tax dollars poured in — turning the state’s second-smallest county from property-poor to property-rich — Somervell built the Squaw Valley Golf Club, Somervell County Expo Center and Texas Amphitheatre, adding to its draw as a popular destination with day trippers from throughout North Texas.

But as energy prices have plummeted, so has the worth of the 23-year-old Comanche Peak, which lost about $330 million in value this year. And now Somervell County finds itself in somewhat of a financial meltdown.

Comanche Peak’s parent company, Luminant Energy, will pay the county about $8.75 million in taxes, down about $250,000 from 2012 and $350,000 from 2011. That’s after county commissioners voted to increase the tax rate nearly 4.5 cents to more than 40 cents per $100 of property valuation.

A six-figure drop may not seem large in the world of municipal budgets. But Comanche Peak accounts for more than half of the county’s $16.5 million budget.

"Comanche Peak has been the county’s cash cow for several decades, so this devaluation really hurts," said Kathryn Jones, editor of the digital news site glenrosecurrent.com and a resident of the county since 2005. "And there’s not really much else to fall back on. … Nothing can really take the place of Comanche Peak."

To understand the financial weight of the mammoth plant, which was valued at $2.2 billion this year, consider that all of downtown Fort Worth is appraised at $2.9 billion.

The most valuable single property in Tarrant County is the huge Grand Prairie Premium Outlets shopping center at Interstate 20 and Great Southwest Parkway, which is appraised at $139 million.

Comanche Peak’s decreasing values, coupled with tax increases including those from a new hospital district, have sparked complaints from many residents who argue that the commissioners simply don’t know how to manage assets.

Jim Willis of Somervell County, a steady critic of the way the county has operated, said the loss of value in the power plant has been coming for years.

"It was no surprise to anybody," Willis said. "In my opinion, the cuts out there haven’t started yet. They just got a little taste of it."

The Somervell County Hospital Authority, which was approved in May by two votes, took about $2 million in operating expenses off the county’s books but added a tax rate of 10.5 cents per $100 of valuation. Combined, the county’s tax increase and the hospital district levy add about $150 a year in taxes for the owner of a $100,000 home.

Glen Rose contractor Chip Harrison has helped organize a petition drive to force a recall election to dismantle the hospital district.

"I think our hospital authority board never looked at hiring an outside management company or selling it to someone like Texas Health Resources as Cleburne did," Harrison said. "At this point, I would be willing to just hand over the keys and let somebody have it."

If a recall election is called and passes, it would definitely affect the county budget.

"Frankly, if this is dissolved, it will have a domino effect on the entire county and it will crush us," County Judge Mike Ford said.

Changes at Squaw Valley

Squaw Valley Golf Club, a rolling, 36-hole layout cut through thick patches of oak trees, is considered one of the top municipal courses in Texas.

But the course, which had been operated by a private company since it opened in 1992, has been as much financial drain as recreational destination.

Squaw Valley made money its first three years but has been in the red every year since. For years, the county has kicked in an average of almost $540,000 annually to keep it running.

County commissioners voted this year to take over operations and immediately began looking for ways to increase revenue and cut costs.

Greens fees have been increased for county residents, a longtime golf course mechanic was let go and pay was reduced for seven hourly and two salaried employees.

The county at first considered selling the course, only to learn that an appraiser valued its nearly 500 acres at $2.5 million, far less than the more than $15.7 million the county has spent on it.

"Nobody felt good," county auditor Brian Watts said. "Everybody was reaching for the bottle of Tums when they saw it."

County Commissioner Larry Hulsey said: "It’s kind of like having a swimming pool in your back yard that nobody wants. The land has more value [to a developer] without a golf course than with it."

This year, with the county running the course, the county’s take is projected to increase to $1.6 million. There will still be a deficit, with expenditures projected at just over $2 million, officials said.

"Our expectation is that we will be able to reduce that deficit to below $200,000 with tighter controls and better policies in place," Watts said.

Hope for ‘The Promise’

Officials are still discussing what to do with the Texas Amphitheatre, which costs the county about $100,000 annually for upkeep and utilities.

County officials have warned that the facility could close unless someone else takes over its management.

The amphitheater is home to The Promise, a popular biblical-based musical in its 25th season.

"We love The Promise," Ford said. "We just don’t know if we can afford to keep it open."

Many of those affiliated with the production, which runs from late August through the last weekend in October, say closing the amphitheater would be a big blow to the area.

"It’s an institution," said Travis Tyre of Arlington, director of this year’s production . "People from all over the country and all over the world know about The Promise."

County officials have been in talks with the show’s producers, and both sides express hope that a deal can be reached to keep the amphitheater open.

"I’m having some good conversations with them over management and maintenance," Ford said. "We don’t want to lose the asset."

Philip Hobson, a Weatherford rancher and businessman who is one of the original Promise board members, remains optimistic that something will be worked out.

"We are putting in a proposal that involves relieving them of the expenses involved with the amphitheater," Hobson said. "It’s such an underutilized facility."

Expo center deficits

The Somervell County Expo Center, which is in the same complex as the amphitheater, is used primarily for equestrian events. A weekly barrel-racing series is being held this month, and in November, the center will host the four-day North Texas Arabian Shootout, among other events.

But even with its busy schedule, the expo center is projected to run a deficit of $921,000 in the upcoming fiscal year. That’s almost the entire $1.4 million combined operating budget for the Somervell County Expo Center and Amphitheatre.

Ford doesn’t want to see the expo center close and says county officials will spend much of this year trying to cut expenses for next year’s budget, as they did this year with the golf course. He believes the county can find a way to make it run more efficiently.

"That’s why individuals don’t run these things, because they don’t make money," Ford said. "But it has a multimillion-dollar effect with the hotel-motel taxes it brings in and the visitors from out of town. We have already started the process of looking at personnel structure, our administrative structure, to make improvements."

Comanche Peak’s plans

But the biggest uncertainty the county faces is Comanche Peak.

Numerous media reports have speculated that Energy Future Holdings, the parent company of Luminant, is headed toward bankruptcy. What that would mean for Comanche Peak remains unclear.

Reuters reported last week that Energy Future, which has more than $40 billion of debt, wants to finalize a restructuring plan before $250 million in bond payments are due Nov. 1.

Last month, Moody’s Investors Service said it expects parts of the company to seek Chapter 11 protection before year’s end.

Ford, the county judge, said he tries to ignore the rumors.

"Somebody calls me weekly saying that they’ve declared bankruptcy or the plant’s been sold," Ford said.

For now, county officials aren’t expecting dramatic changes and remain hopeful that the plant’s value won’t drop significantly again.

"I don’t honestly think a bankruptcy will have a big effect on us," Chief County Appraiser Wes Rollen said. "To me, a bad scenario for us would be if it sold at half or 75 percent of what we have it for now on the books."

If energy prices rebound, Rollen said, the value of the plant could increase. As recently as 2007, it was valued at $2.7 billion, he said.

Luminant spokesman Brad Watson said the company does not expect changes at Comanche Peak, which employs 1,200.

"We do not anticipate that any potential restructuring would impact Comanche Peak or any of our operations since it would be a financial, not an operational, restructuring," Watson said.

Preparing for future

Dennis Moore, mayor of the county seat of Glen Rose, said he isn’t a fan of government-run enterprises but said his city has benefited from county facilities that attract tourists to stay at motels and eat at restaurants. Because Comanche Peak is outside the city, Glen Rose doesn’t receive any of its property tax benefits.

"If they had to shut down or cut back on something, it’s going to affect us," Moore said.

Officials with the Glen Rose school district, which also receives money from Comanche Peak, said they are more concerned with state budget cuts than with the loss in property taxes from the plant.

"It’s had an impact on us but how it impacts is much different than with the county," Superintendent Wayne Rotan said said. "The state budget cuts have impacted us the most."

If the plant is further devalued, it could eventually affect the school district, but Rotan said trustees have set aside $20 million in reserves as a safeguard.

Other efforts are underway to bolster the county’s tax base.

George Best, who retired to Glen Rose seven years ago from Coppell, is a member of the recently formed Somervell Economic Development Council, which is working to ensure that the county benefits from the construction of the Chisholm Trail Parkway.

The toll road, which is scheduled to open in mid-2014, is expected to cut about 15 minutes off the hourlong drive from Fort Worth to Glen Rose, Best wrote in an email.

"As a result, we believe our community will experience growth as families discover our hometown atmosphere, low (by Metroplex standards) property taxes and exemplary schools," Best said.

The council also wants find ways to encourage commercial growth and promote the area as a retirement community, he said.

"We want to make sure we are … attracting businesses that are complementary with our current tourism and industrial base, along with our community culture," Best said.

This report includes material from the Star-Telegram archives.

Bill Hanna, 817-390-7698 Twitter: @fwhanna

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

159 Comanche Peak safety violations noted in federal report

Dallas Moorning News File/Staff Photo

October 15, 2013

The Associated Press

via Dallas Morning News

The Comanche Peak nuclear power plant had 157 lower-level and two higher-level safety violations between 2000 and 2012, according to a federal report.

GLEN ROSE — An unreleased report says two Texas nuclear power plants each experienced more than 150 lower-level safety violations from 2000 through 2012.

The data were included in a Government Accountability Office report obtained by The Associated Press. It is intended to show that safety violations at nuclear plants vary from region to region, in part because of differing rules interpretations. The West region, which includes Texas, had 2 1/2 times the Southeast’s rate of lower-level violations per reactor.

The Comanche Peak plant in Glen Rose had two higher-level violations in addition to its 157 lower-level violations. The South Texas Project plant in Wadsworth had 151 lower-level and no higher-level.

Brad Wilson, a spokesman for Luminant, which owns Comanche Peak, said the company would not comment on a report it couldn’t review.

Lower-level violations pose very low risk. Higher-level violations range from low to high safety significance.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Reactor is shut down at Comanche Peak nuclear plant

Nov. 03, 2012

BY JIM FUQUAY

Fort Worth Star-Telegram

One of the two reactors at the Comanche Peak nuclear power plant near Glen Rose was shut down early Friday after a cooling pump overheated, the operator reported.

According to an event report filed with the Nuclear Regulatory Commission, Unit 1 was shut down manually at 1:42 a.m. because of "high temperature indications" in a motor bearing on one of four huge pumps that circulate cooling water around the reactor.

An alarm that warns of an improper level of oil for the pump also sounded, the report stated.

Dallas-based Luminant Generating, the plant’s operator, is "currently looking into a cause" of the pump problem, spokeswoman Ashley Barrie said.

The reactor had to be shut down to remove the pump for servicing, she said.

Luminant is "developing a maintenance plan to resolve the issue. We anticipate returning the unit to service as soon as this work is completed," Barrie said.

Arjun Makhijani, president of the Institute for Energy and Environmental Research and a critic of using nuclear power to generate electricity, said that "anytime you manually shut a reactor down, it’s a big deal."

Although the sequence of events described in the NRC report sounded like the correct action, he said, "a manual trip is a nonroutine safety event."

Barrie said, "There was never any safety issue at the plant."

The Unit 1 reactor also experienced an unusual event Wednesday morning when a backup generator started unexpectedly. According to an NRC event report, a faulty power supply "was identified and further investigation/calibration will determine if other conditions contributed to the fault."

Barrie said, "The equipment malfunction that occurred on Wednesday is in no way tied to the manual trip" on Friday. The equipment that started the generator was replaced "and verified satisfactory through testing," she said.

Together, Comanche Peak’s two reactors can produce 2,300 megawatts of electricity. They are among the nation’s newest nuclear power plants, with Unit 1 going into operation in 1990 and Unit 2 in 1993, according to Luminant.

Unit 2 had been down several weeks for refueling and had just returned on line Friday morning, Barrie said. Nuclear reactors are typically refueled every 18 months, generally in spring and fall when temperatures are moderate and electricity demand is light.

Robbie Searcy, spokeswoman for the Electric Reliability Council of Texas, which operates the state’s largest power grid, said Unit 1’s sudden loss triggered automatic responses by big industrial users that agree to have their power interrupted to accommodate such events. ERCOT then calls on standby generators to replace the power the Comanche Peak unit had been providing to the grid.

It was fortunate Unit 1 went down in the early morning, when demand is especially low, Searcy said.

Jim Fuquay, 817-390-7552

Twitter: @jimfuquay

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Comanche Peak expansion thrown into doubt

December 09, 2010

By Maria Recio

mrecio(at)mcclatchydc.com

Fort Worth Star-Telegram

WASHINGTON — The planned $15 billion expansion of the Comanche Peak nuclear power plant — billed by the plant’s owners as potentially the biggest economic development project ever in Texas — suffered a critical funding setback in Congress this week.

According to outgoing Rep. Chet Edwards, D-Waco, cuts in the House-passed version of the federal spending bill eliminate loan guarantees that Dallas-based Luminant said were vital to the plan’s viability.

According to outgoing Rep. Chet Edwards, D-Waco, cuts in the House-passed version of the federal spending bill eliminate loan guarantees that Dallas-based Luminant said were vital to the plan’s viability.

Luminant officials say they will continue to push for funding, and Edwards said he hopes the loan guarantees will be approved in the next session of Congress that convenes in January.

But Republicans who pledge even more budget-cutting will take control of the House then, and most observers expect that efforts to increase spending on such things as nuclear plant expansions will face even greater obstacles.

Things had been looking up earlier this year for the proposed expansion of the plant near Glen Rose, about 45 miles southwest of Fort Worth, after President Barack Obama pushed to triple the amount of loan guarantees from the $18.5 billion that had been previously authorized to $54.5 billion. Four plants had been named top choices to receive guarantees from the initial funding, but Comanche Peak missed the cut.

Edwards, who lost his seat to Republican Bill Flores last month, succeeded at the committee level in getting an additional $25 billion in guarantees, which many observers believed would have been enough to cover the Glen Rose expansion.

But the full House, under intense public pressure to slash spending, this week cut the level back to $7 billion in the catch-all government spending bill known as a continuing resolution — an amount that Edwards believes will not take care of Comanche Peak.

The U.S. Senate will vote on the spending bill next week, and it is not clear whether lawmakers who support the loan guarantee program, like Sen. Kay Bailey Hutchison, R-Texas, can do anything to boost the funding before Congress adjourns before Christmas.

Comanche Peak may not receive any loan guarantees under the reduced funding level because it is far down on the priority list set by the Energy Department, Edwards said. Projects in Georgia, Maryland and another Texas facility — NRG’s South Texas Project in Bay City — rank higher, and there may now be only enough money to fund the projects ahead of it.

Edwards said in a statement that losing the election to Flores meant that "I lost my leverage to protect the full $25 billion." Nonetheless, he said he hopes the funding will be approved by the next Congress "because Texas and our nation need nuclear power and the thousands of jobs that come with it."

Luminant officials say they’re not giving up, and spokeswoman Ashley Monts said that even the small increase still on the table in Congress "is an important step in the nation’s nuclear development plans."

"This is a long-term investment opportunity, and we expect that the loan guarantee dialogue will continue to evolve and expand," she said.

Critics of the expansion are pleased.

"They have not been among the front-runners for federal loan guarantees, and that makes it much harder for Comanche Peak to go forward," said Karen Hadden, director of the Austin-based Sustainable Energy and Economic Development Coalition.

Luminant is seeking federal approval for a combined construction and operating license, plus the federal loan guarantees considered crucial to secure financing. The company estimates that the expansion would create 5,000 jobs during five years of construction and more than 500 permanent jobs.

Maria Recio is the Star-Telegram’s Washington bureau chief. 202-383-6103

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.