Author Archive

Nuclear waste dump foes argue case at Texas hearing

Friday December 10, 2010

By BETSY BLANEY / Associated Press

Lubbock Avalanche-Journal

LUBBOCK, Texas — Opponents of a plan to allow nuclear waste from 36 other states to be buried near the Texas-New Mexico border raised their concerns Thursday at a public hearing, complaining that the rules are being rushed through the approval process.

Craig McDonald of Texans for Public Justice was among the 25 people who argued against the proposal during the meeting of the Texas Low-Level Radioactive Waste Disposal Compact Commission in Austin. He called it a "rush to radiation," suggesting the 30-day comment period that ends Dec. 26 doesn’t allow nearly enough time to weigh the issues, particularly because it comes during the holiday season.

"In the development of the timeline for this rule the commercial interests have been placed well ahead of the public interest," he said. "Public safety and fiscal responsibility demand a much more thorough examination of the consequences of the adoption of this rule."

But Rick Jacobi, a licensed nuclear engineer speaking on behalf of the company that operates the site, Dallas-based Waste Control Specialists, said the commission has given the public ample time to comment.

"This rule has been more than thoroughly reviewed, debated, discussed, amended and considered by both the public and the commission," Jacobi said.

A previous set of rules withdrawn for revisions this summer had allowed for a 90-day comment period.

Opponents of the plan far outnumbered the supporters at the meeting and expressed concerns about the potential dangers of transporting the waste and the threat to the Ogallala Aquifer and other groundwater sources should radiation leak from the site. Supporters of the site say the Ogallala is not beneath the property.

The eight-member commission made up of appointees by the governors of Texas and Vermont approved the wording of the proposed rules last month. Those states have a compact that allows both states to bury nuclear waste at the privately operated site in West Texas.

Waste Control Specialists, which got its license to dispose of low-level nuclear waste last year, has yet to receive final approval from Texas environmental regulators to build the compact’s disposal facility 30 miles west of Andrews.

The Texas Commission on Environmental Quality is considering an amendment to the company’s disposal license that would modify the design and construction of the compact’s site and change its environmental monitoring.

Texas and Vermont have already been given clearance to bury at the site once the facility is built. Federal waste will be disposed at the site but in a separate location on the property.

In the early 1980s, the federal government started urging states to build low-level nuclear waste landfills, either on their own or in cooperation with other states in compact systems Since then, South Carolina entered into a compact with New Jersey and Connecticut, agreeing to dispose of nuclear waste at a landfill that later accepted waste from dozens of other states.

Should the proposed rules be adopted by the commission, low-level radioactive waste from 36 other states could be also dumped at a privately run facility in a remote region of West Texas. Requests for importation or exportation would be considered on a case-by-case basis.

The waste would become the property of Texas once the disposal facility accepts the low-level waste, and the state would be liable for any possible future contamination after the facility closes.

If the more recent proposed rules are approved, the new disposal site would start taking worker clothing, glass, metal and other low-level materials currently stored at nuclear power plants, hospitals, universities and research labs.

The commission hasn’t yet set a date for its next meeting.

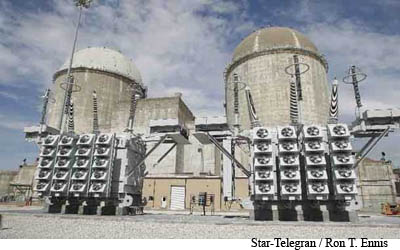

Comanche Peak expansion thrown into doubt

December 09, 2010

By Maria Recio

mrecio(at)mcclatchydc.com

Fort Worth Star-Telegram

WASHINGTON — The planned $15 billion expansion of the Comanche Peak nuclear power plant — billed by the plant’s owners as potentially the biggest economic development project ever in Texas — suffered a critical funding setback in Congress this week.

According to outgoing Rep. Chet Edwards, D-Waco, cuts in the House-passed version of the federal spending bill eliminate loan guarantees that Dallas-based Luminant said were vital to the plan’s viability.

According to outgoing Rep. Chet Edwards, D-Waco, cuts in the House-passed version of the federal spending bill eliminate loan guarantees that Dallas-based Luminant said were vital to the plan’s viability.

Luminant officials say they will continue to push for funding, and Edwards said he hopes the loan guarantees will be approved in the next session of Congress that convenes in January.

But Republicans who pledge even more budget-cutting will take control of the House then, and most observers expect that efforts to increase spending on such things as nuclear plant expansions will face even greater obstacles.

Things had been looking up earlier this year for the proposed expansion of the plant near Glen Rose, about 45 miles southwest of Fort Worth, after President Barack Obama pushed to triple the amount of loan guarantees from the $18.5 billion that had been previously authorized to $54.5 billion. Four plants had been named top choices to receive guarantees from the initial funding, but Comanche Peak missed the cut.

Edwards, who lost his seat to Republican Bill Flores last month, succeeded at the committee level in getting an additional $25 billion in guarantees, which many observers believed would have been enough to cover the Glen Rose expansion.

But the full House, under intense public pressure to slash spending, this week cut the level back to $7 billion in the catch-all government spending bill known as a continuing resolution — an amount that Edwards believes will not take care of Comanche Peak.

The U.S. Senate will vote on the spending bill next week, and it is not clear whether lawmakers who support the loan guarantee program, like Sen. Kay Bailey Hutchison, R-Texas, can do anything to boost the funding before Congress adjourns before Christmas.

Comanche Peak may not receive any loan guarantees under the reduced funding level because it is far down on the priority list set by the Energy Department, Edwards said. Projects in Georgia, Maryland and another Texas facility — NRG’s South Texas Project in Bay City — rank higher, and there may now be only enough money to fund the projects ahead of it.

Edwards said in a statement that losing the election to Flores meant that "I lost my leverage to protect the full $25 billion." Nonetheless, he said he hopes the funding will be approved by the next Congress "because Texas and our nation need nuclear power and the thousands of jobs that come with it."

Luminant officials say they’re not giving up, and spokeswoman Ashley Monts said that even the small increase still on the table in Congress "is an important step in the nation’s nuclear development plans."

"This is a long-term investment opportunity, and we expect that the loan guarantee dialogue will continue to evolve and expand," she said.

Critics of the expansion are pleased.

"They have not been among the front-runners for federal loan guarantees, and that makes it much harder for Comanche Peak to go forward," said Karen Hadden, director of the Austin-based Sustainable Energy and Economic Development Coalition.

Luminant is seeking federal approval for a combined construction and operating license, plus the federal loan guarantees considered crucial to secure financing. The company estimates that the expansion would create 5,000 jobs during five years of construction and more than 500 permanent jobs.

Maria Recio is the Star-Telegram’s Washington bureau chief. 202-383-6103

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

New York relying much less on Indian Point for energy

Tuesday, 07 December 2010

BY ROGER WITHERSPOON

NEWJERSEYNEWSROOM.COM

Entergy Nuclear has dropped its share of electricity supporting New York City and Westchester County to about 4 percent of the area’s power needs while selling increasing portions of its juice in an open market stretching from Maine to Delaware.

Entergy Nuclear has dropped its share of electricity supporting New York City and Westchester County to about 4 percent of the area’s power needs while selling increasing portions of its juice in an open market stretching from Maine to Delaware.

The company is spending millions of dollars on an extensive campaign to convince the public that the region would suffer if the nuclear plants at Indian Point were shut and its 2,100 megawatts were withdrawn. Simultaneously, however, Entergy is withdrawing all but 560 megawatts and is selling the rest elsewhere through the interconnecting New England, New York, Mid-Atlantic, Quebec and Ontario power grids.

In its search for the highest profit margins, industry analysts and power operators say Entergy may well opt to sell nearly all of its electricity from Indian Point 2 and 3 in Buchanan to customers outside the New York City/Westchester County service area. And because of the success of the wholesale power markets and transmission networks run by the non-profit Independent System Operators, the absence of Indian Point’s megawatts has no effect on the region’s electricity needs or power system reliability.

"Whether or not Entergy is going to phase out of New York City and Westchester entirely is an open question," said Justin McCann, senior industry analyst for Standard & Poor’s Equity Markets. "If you look at Gov. Cuomo, there is a hostile political environment, so there is going to be a tension here and how that is going to play out, I have no idea.

"Whether or not Entergy is going to phase out of New York City and Westchester entirely is an open question," said Justin McCann, senior industry analyst for Standard & Poor’s Equity Markets. "If you look at Gov. Cuomo, there is a hostile political environment, so there is going to be a tension here and how that is going to play out, I have no idea.

"But they will go wherever they see the best market."

Entergy bought the Indian Point 3 and James A. FitzPatrick nuclear power plants from the New York Power Authority in 2000, and Indian Point 1 and 2 from Consolidated Edison in 2001. At that time, Con Ed was getting out of the power generating business and concentrating on being solely an electric transmission company. In that capacity, it delivers all of the electricity used in the New York City/Westchester section of the state’s power grid. Con Ed’s transmission lines carry some 9,000 to 13,000 megawatts of electricity during peak periods, with the highest usage occurring during the hottest days of summer. The 2000 megawatts provided by the twin reactors at Indian Point accounted for 22% of that energy mix in winter and 15 percent in the summer.

Under terms of the separate sale agreements, Entergy contracted to sell all of the power from Indian Point 2 to Con Ed, and all of the power from Indian Point 3 to NYPA. But these contracts were not open ended. The power markets were deregulated in 1999, just a year before the sales occurred, and how well the networked wholesale markets would work was still more theory than fact. Locking up Indian Point’s electricity at a set price point for at least five years was deemed a prudent measure for Con Ed and NYPA to take as the free market system evolved.

Entergy’s contract with Con Ed required Indian Point 2 to provide 1,000 megawatts through 2009. The output fell to 875 megawatts through 2010, and drops further to 360 Megawatts for 2011 and 2012, according to Con Ed spokesman Chris Olert and the company’s 2010 Annual Report.

NYPA’s contract with Entergy for 2009 through 2013 secures just 100 megawatts from Indian Point 3 and 100 from Indian Point 2. The current contracts with NYPA and Con Ed, therefore, drop Indian Point’s contribution to the region’s electricity needs to just 6.2 percent in winter and 4.3 percent in the summer.

For NYPA, replacing that drop of 800 megawatts was not an obstacle, said spokesperson Connie M. Cullen.

"It was not difficult," Cullen said. "NYPA follows an established procurement process where we issue a request for proposals from electricity suppliers, receive bids, evaluate them, and then enter contracts. It is a well established process."

It needs to be.

Both NYPA and Con Ed purchase power wholesale and then sell it to residential, business and municipal customers. NYPA, which has its own hydro electric plants upstate, provides some 2015 megawatts of power to the region daily. According to NYPA, that breaks down to 115 megawatts for Westchester County municipal customers, government buildings, and Westchester airport; and 1,900 megawatts for New York City’s government buildings and operations, the city Housing Authority, Metropolitan Transit Authority, state buildings, LaGuardia Airport, and the Jacob Javits Convention Center. JFK Airport has its own power generation.

Con Ed, on the other hand, has its own residential and non-government business customers, delivering 9,000 to 11,000 megawatts to some 345,000 Westchester and 2.8 million New York City residents.

Entergy’s individual contracts are not a matter of public record and the company may be selling electricity to large clients in this region. But their contention that it is the electricity from Indian Point which keeps the subways running, La Guardia Airport operating, and the lights on at City Hall are no longer valid.

The disclosure that Entergy has quietly shifted its electricity elsewhere prompted an angry response from Gary Shaw of the Indian Point Safe Energy Coalition, which is comprised of several non-profit organizations seeking to block relicensing of the plants.

"We have known for a long time that Entergy has no credibility," said Shaw. "But this new revelation is a factual contradiction of their contention that Indian Point’s output is vital to our region.

"We have known for a long time that Entergy has no credibility," said Shaw. "But this new revelation is a factual contradiction of their contention that Indian Point’s output is vital to our region.

"Indian Point represents a nuclear risk to the residents of this area while supplying only a small fraction of its electricity needs. We would be foolhardy to give it another 20 years to operate in our backyard when we are getting so little benefit."

Kenneth Klapp, spokesman for the New York ISO, said large power generators like Entergy have two options for their product. "They can sell electricity in the wholesale markets we operate," Klapp explained, "or bilaterally by themselves to a load serving entity — which is a transmission company like Con Edison or a large individual customer.

"In New York State, 50% of the energy sold is bilaterally through contracts and the other half goes to either of the two markets we operate: the day-ahead market, which gets the majority of the traffic; and the real time, spot market which is dispatched every five minutes. We have 300 market participants in New York. But providers like Entergy can bid into other markets as well."

By participating in the New York ISO, Indian Point is in an expanded marketplace provided by the ISO New England, Pennsylvania-Jersey-Maryland ISO, the Ontario ISO and the Quebec Provincial Utility.

In the current, volatile energy marketplace there are good reasons for Entergy to shop around. Standard & Poor’s McCann said "the spot market at this time is weak. If you look at the market now for next July, the prices are between $47 and $48 dollars a megawatt/hour. And the prices will be lower in 2011.

"But Entergy has contracts for 90% of their output through the end of this year and throughout 2011 at $57 per megawatt hour. For 2012 they have already contracted 76% of their output at $50; for 2013 they have sold 31% at $49; for 2014 and 2015 they have sold 25% at $51. It is prudent for them to lock in prices at this time."

It is equally prudent for Con Edison and NYPA to reduce their dependency on Indian Point’s electricity at a time when their nuclear plant operating licenses are expiring and their long term future is still not decided.

Part of the reason the electricity from Indian Point has been considered so vital to the New York City /Westchester electric infrastructure is due to widespread misunderstanding of the term "baseload electricity." The use of that term by nuclear industry proponents usually implies that it is an essential foundation on which regional electricity needs are built. That is not the case.

"We have three classifications of electricity providers," said Ellen Foley, spokeswoman for ISO New England, which includes Entergy’s Vermont Yankee and Pilgrim nuclear plants in its energy mix. "Baseload plants typically run all of the time. Intermediate plants can go on and off, or increase and decrease their power in a short period of time. The peak units can be turned on or off in 10 minutes and are used — as their name implies — in periods of very high demand.

"It can take a couple of days to power up a nuclear plant. If that changed, and they had more flexibility and could power up and down in a short time, they would be considered intermediate just like hydro or natural gas."

Nuclear power is considered baseload because, when compared to other forms of power generation, they have an inferior on/off switch.

Since they have to operate at full capacity, Foley said, "Typically what they will do is sell their output through contractual arrangements to stay on line at their maximum level. With Vermont Yankee, there is no way to know how much of their power stays in Vermont and how much goes elsewhere. More than likely, they are running and selling their power throughout New England."

While the market place is wide open and constantly evolving, some things do not change.

"Entergy can sell electricity wherever there is a buyer," said McCann, "but it cannot produce it wherever it wishes to. Physically, they are here. These people will negotiate for every nickel and dime, but I can’t see them abandoning Indian Point."

Q: How much electricity do Indian Point 2 and 3 produce?

A: According to Entergy’s annual report for calendar year 2009, Indian Point 2 produces 1,028 megawatts of electricity and Indian Point 3 produces 1,041 megawatts.

Q: How much electricity is used in the New York City / Westchester County service area of the NY State power grid?

A: New York City and Westchester County use 9,000 to about 13,000 megawatts of electricity during peak periods daily, according to Consolidated Edison, which transmits all of the electricity. The lowest use is in the winter, the highest in the summer.

Q: What percentage of the area’s electrical needs was met by Indian Point when it sold all of its power to Con Ed and NYPA?

A: The percentage ranged from about 22% in the winter to 15% in the summer.

Q: What percentage of the area’s electrical needs is met by Indian Point now?

A: The 560 megawatts contracted to Con Ed and NYPA amount to 6.2% in the winter and 4.3% in the summer.

Q: Entergy claims Indian Point provides up to 40% of the electricity used in the New York City/ Westchester County grid. How do they arrive at that figure?

A: Energy use is based on the peak, or maximum load of the day when people are actually using electricity. For Entergy’s 40% claim to be accurate,electricity usage in New York City and Westchester would have to fall to only 5,000 megawatts.

Con Ed reports that the energy load drops to that level between 3 AM and 5 AM, Sunday mornings, about three times in the late spring and three times in the early fall when it is too cool for air conditioning, too warm for electric heaters, and the city sleeps. During those isolated periods the 2,000 megawatts from Indian Point – if it were all used in the region – would comprise 40%.

Q: Is it legitimate to use the exception – when everyone sleeps – to calculate Indian Point’s value to the regional power grid?

A: No. The industry’s buyers and providers base their contracts on maximum projected electricity use, not the occasional exceptional circumstance.

If it were legitimate to use the exception, when most electrical systems were turned off, it would also be legitimate to claim that the most consistent power source in the region is the Eveready Bunny, whose batteries powered flashlights throughout the New York City/ Westchester County grid during the 2003 Blackout.

Q: How much electricity is generated in New York state?

A: According to the New York Independent System Operator, which runs the power grid, total electric power generation in the state is 37,416 Megawatts transmitted over 10,877 miles of high voltage lines.

Q: How much electricity is generated in the New York City/ Westchester power section of the grid?

A: The NY ISO reports there are 11,087 Megawatts of generating capacity in this region.

Q: What were the peak electric load forecasts for 2009 and this year?

A: The NY ISO reported the projected peak usage for 2009 was 33,425 Megawatts though the actual peak reached just 30,844 Megawatts. The projected peak this year was 33,025 Megawatts.

Q: How has the price of electricity changed in the wholesale marketplace?

A: The average annual cost of electricity in 2008 was $95.31 per megawatt/hour. In 2009, the average annual cost of electricity was $48.63 per megawatt/hour.

Q: How does the cost of natural gas affect the price of electricity generated by nuclear power?

A: Natural gas sets the market price in the day-ahead and spot markets, which are calculated every 5 minutes. Nuclear power comes in at a lower cost than natural gas and the difference is the profit earned by the nuclear operator.

Q: How much of the electricity generated in New York is sold in the markets and how much is sold under long-term contracts?

A: About half the electricity generated in New York is sold under long term contracts to distributors such as Con Ed and NYPA, or to individual users like Fordham and New York Universities, and the Metropolitan Transit Authority. The remaining 50% is sold on either the day-ahead, or the spot markets.

Q: Must the electricity made in New York be sold to companies or distributers within New York?

A: No. The NY ISO is connected to ISO New England, the Pennsylvania-Jersey-Maryland ISO encompassing the Mid-Atlantic states and, in Canada, the Ontario ISO and the Quebec Provincial Utility. Electricity can be sold in the day-ahead and spot markets, or long term contracts made to clients throughout the network.

Q: What does Indian Point primarily rely on: long-term contracts or the markets?

A: According to an analysis by Standard & Poor’s Entergy has contracts for 90% of Indian Point’s electricity this year; 95% of its output in 2011, 76% of its output in 2012, 31% of its output in 2013, 25% of its output in 2014, and 15% of its output in 2015.

Locally, Indian Point is contracted to provide NYPA with 200 megawatts through 2013. It is contracted to provide Con Ed 875 megawatts through the end of 2010, and 360 megawatts through 2012.

Roger Witherspoon writes Energy Matters at

www.RogerWitherspoon.com

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Texas Proposal Spurs Race to Dispose of Nuclear Waste

December 2, 2010

By MATTHEW L. WALD

New York Times

WASHINGTON — Aged nuclear plants in Vermont and Illinois may be playing the equivalent of musical chairs in a graveyard, vying for space at a dump in Texas whose owner hopes to accept radioactive waste from many other states.

Under an alliance struck 16 years ago between Vermont and Texas, tiny Vermont can fill up to 20 percent of the space at any low-level nuclear waste dump built in Texas’ wide-open spaces. Texas got the right to exclude other states’ waste. But as a company prepares to begin construction this month on the state’s first one, the arrangement may be jeopardized by swiftly changing circumstances.

A private company that won a contract to operate the plant, at a site in Andrews on the New Mexico border, wants to accept waste from the 36 states that do not have access to a dump for some of their waste now. And a commission made up of representatives from the two states that controls the planned dump has proposed a rule for accomplishing that.

Waste disposal is so difficult, says the company, Waste Control Services, that power plants and other generating sources have reduced their volumes sharply. And Vermont and Texas together produce so little that, the company adds, it would have to charge huge amounts per cubic foot and per unit of radioactivity to get its investment back.

The prospect of losing space to waste from generators in other states worries the incoming governor of Vermont, Peter Shumlin, who has vowed to shut down that state’s reactor, Vermont Yankee. He fears that when it comes time to tear it down, there will not be enough space for its contaminated components in Texas if other plants can ship waste there first.

"It’s a race for space," said Mr. Shumlin, a Democrat. "When push comes to shove, the first waste that arrives is the waste that gets in."

Not everyone in Vermont agrees. The state has two seats on an eight-member bi-state commission that controls the dump, and its delegates, chosen by Mr. Shumlin’s predecessor, support the change in rules for imported waste. By law, they say, the compact allows states to charge nonmembers much higher rates.

The Texan chairman of the commission, Michael S. Ford, says Vermont has little to worry about. "The Compact Commission will vigorously protect the interests of our sole and loyal partner, Vermont, in the compact and assure that their disposal needs are well known and fully accounted for," he wrote in an e-mail.

But nuclear experts in Vermont suggest it would be wiser for the commission to postpone a decision on imports until it determines how much space Vermont Yankee’s waste will need.

Nuclear operators around the country are watching with interest. In Zion, Ill., north of Chicago, for example, a company called EnergySolutions is decommissioning a twin-unit reactor and plans to put the least radioactive material in its own dump, in Clive, Utah, but wants to ship slightly more contaminated material to Andrews.

The arrangement between Vermont and Texas was brokered under federal laws passed in the 1980s to encourage states to establish dumps for low-level waste. The laws allowed the forging of "low-level waste compacts," under which a state could select a future dumping site from which other states would be turned away. (Maine was initially also part of the compact with Vermont and Texas but dropped out.)

Mr. Shumlin said he saw the hand of Entergy, a company based in Louisiana that owns Vermont Yankee, in the proposal to expand the compact. The company owns 10 other reactors in six other states, none of them with access to a low-level waste dump, including the Indian Point reactors in New York.

He suggested that the backers of the proposed rule were rushing to get it in place before he takes office on Jan. 6 and gains the power to replace the Vermonters on the commission who favor the new rule.

The day after he was elected governor last month, the commission approved a draft rule and put it out for public comment. The comment period will end Dec. 26, and the commission could vote anytime after that.

Mr. Ford denied there was any last-minute scramble, saying that the commission had been working on the proposed rule since last year.

Of the six panel members from Texas, two are said to oppose allowing waste imports from additional states and four are said to favor it. With the Vermonters, that points to a 6-to-2 vote in favor of the new rule.

Mr. Shumlin said he would seek to appoint two commissioners who opposed changing the rule. That would lead to a 4-to-4 tie and prevent the passage of the rule.

For its part, Entergy, which recently put Vermont Yankee up for sale because the state has refused to let the company keep running it beyond 2012, said it agreed that Vermont’s access should be protected.

The dump, expected to cost $75 million, will be a concrete-lined hole in the ground set in nearly impermeable red clay, which is supposed to prevent the waste from contaminating underground water supplies.

"They’re trying to get it done before the new governor takes office," said Tom Smith, director of the Texas office of the consumer advocacy group Public Citizen, which opposes the dump.

Asked whether Gov. Rick Perry of Texas had taken a position, a spokesman said he expected that the commission "will ultimately make a decision that is in the best interest of Texas."

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Jinxed Plant Slows A Nuclear Rebirth

December 2, 2010

Guy Chazan

Wall Street Journal

OLKILUOTO, Finland— A thickly wooded island off the west coast of Finland is the cradle of the global nuclear renaissance, but it’s been a difficult birth.

French engineering company Areva SA is building the world’s first new-generation nuclear reactor here. Some 4,000 workers from across Europe toil in the shadow of its vast concrete containment dome.

But the Olkiluoto-3 reactor has had a deeply troubled history. Originally slated to cost around $4 billion (€3 billion), its price tag has nearly doubled to $7.2 billion (€5.3 billion). And it is four years behind schedule.

Areva, whose main shareholder is the French government, and its Finnish customer, Teollisuuden Voima Oyj, or TVO, have had a spectacular falling out over the project. The two are countersuing each other for compensation over the delays, with TVO accusing Areva of gross negligence.

The French insist the project is a success. "It’s an investment in the future," says the project director, Jean-Pierre Mouroux. "It’s the first of a kind, and we’ve learned a lot of lessons."

Capable of powering 1.5 million homes, and designed to withstand a 9/11-style direct hit by a commercial airliner, Olkiluoto was to be the flagship of the global nuclear revival. Instead it has become a symbol of the enormous cost, complexity and risk of new nuclear projects.

"If it were any other product, it would have been binned by now," says Steve Thomas, professor of energy policy at London’s University of Greenwich.

Nuclear power’s reputation was badly marred by the 1986 Chernobyl catastrophe and the 1979 accident at Three Mile Island. But it has made a comeback as rising concern about energy security and global warming have increased the appeal of nonfossil fuels. Some 58 nuclear reactors are currently being built in 15 countries.

Yet the economics of nuclear energy have deteriorated, especially in the U.S., where the shale gas boom has driven down the price of natural gas, making alternatives like nuclear less competitive. Meanwhile, nuclear plants remain expensive to build: A new gas-fired power plant costs around $1 billion, or $1,000 a kilowatt, while a nuclear plant can cost at least five times that.

Nuclear advocates stress the low operating costs once a reactor is running. They also say the price tag won’t seem so high if gas and coal-fired plants have to start paying for the carbon dioxide they emit.

Yet after Olkiluoto, utilities increasingly worry about the risk of cost blowouts and long delays. "If the vendors can’t tell them definitively how long it’s going to take to build a reactor, how can they go to market and get financing?" asks Ann Mac Lachlan, European head of Platts Nuclear Publications. "Such uncertainties are killing the nuclear industry in the U.S."

The reactor being built in Finland, the European Pressurized Reactor, or EPR, was the fruit of research efforts by Areva and Germany’s Siemens AG to create a new generation of safe, efficient nuclear plants.

It boasts a "core-catcher," or concrete basin designed to trap and douse the reactor core in the event of a meltdown. The reactor itself is sheathed in a steel-lined double concrete shell strong enough to withstand an air attack.

In 2003, Finland became the first country to order an EPR. Soon, Areva got an order for another one, in Flamanville, France, and for two more in Taishan, China.

But Areva and Siemens didn’t have detailed design documents ready when construction on Olkiluoto started, and they underestimated the time it would take to complete them, setting the scene for big delays.

Then, regulators stopped work at the site for several months after it emerged that the concrete mix used to build the base of the plant was too watery.

Finland’s nuclear safety regulator, STUK, criticized Areva’s concrete supplier, saying it and other subcontractors had "no prior experience in nuclear power plant construction." It also said Areva appeared to have chosen companies on the basis of price rather than expertise.

Areva blames its difficulties on the 20-year hiatus in the nuclear industry. "The supply chain was lost after the end of the 1990s, and we had to revive it," says Mr. Mouroux.

Inspectors also uncovered welding problems: The gaps between the panels of the steel liner encasing the reactor were larger than specified in the design documents, they noted. The discrepancy, STUK said, was "absolutely unacceptable."

In 2008, STUK demanded changes to Olkiluoto’s automation systems, and the following year, it halted work on the pipes of the reactor’s critical cooling system after it discovered welders had violated procedures. Areva itself had to scrap piping made for Olkiluoto at its fabrication plant in France after it discovered the components didn’t comply with the Finns’ stricter safety requirements.

Areva blames the Finns for the delays. "Some minor adjustments to the design took weeks to be approved, when they should have been resolved on the spot," Mr. Mouroux says.

STUK’s response is contained in its 2006 report: "Finnish preciseness and attention to detail are of a level which the plant vendor did not expect," it said.

Areva encountered problems elsewhere, too. The second EPR, being built in Flamanville by Electricité de France SA, the French power group, was also beset by cost overruns and delays.

In 2008, South Africa called off a plan to build a new fleet of nuclear reactors after bids from Areva and Westinghouse Electric Co, a Toshiba Corp. unit, came in higher than expected. Canada made a similar about-face.

Then, last December, Areva’s EPR lost out to a cheaper, simpler South Korean model in the United Arab Emirates.

Shocked, the French government asked a former CEO of EDF, Francois Roussely, to write a report on the state of the nuclear industry. He concluded that the difficulties at Olkiluoto and Flamanville had "seriously undermined" the EPR’s credibility.

In the U.S., Areva also suffered setbacks. Last month, Constellation Energy Group Inc. pulled out of a venture with EDF to build an EPR at Calvert Cliffs in Maryland, complaining that the terms of a federal-loan guarantee were too tough.

Areva is still confident about the EPR’s prospects, though. The U.K. is in the process of approving the reactor’s design and could order up to four. India may order two. And Areva insists the two EPRs being built in Taishan are on schedule and on budget.

Still, the pace of nuclear expansion is much slower than many had predicted just a few years ago. "The bottom has really fallen out of the nuclear renaissance," says Ms. Mac Lachlan.

Write to Guy Chazan – guy.chazan(at)wsj.com

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.