Author Archive

Fission may fizzle as nuclear power reacts to economics

April 3, 2015

By Ryan Holeywell

Houston Chronicle

Excerpt:

"This is the best the 1970s had to offer," says James Von Suskil, vice president of nuclear oversight for NRG Energy, one of the owners of the plant in Matagorda County 80 miles southwest of Houston. Some components on the control panel are so old that the plant operators look to the auction website eBay for parts.

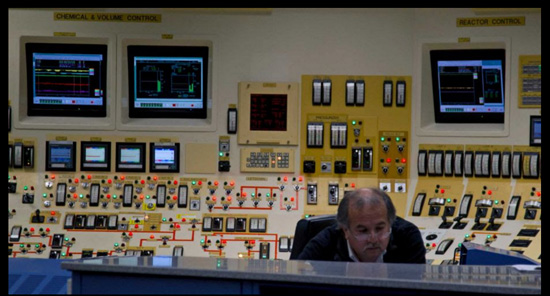

An operator works in the control room of Unit 1 at the South Texas Project nuclear power plant in Wadsworth.

© 2015 Houston Chronicle Photo: James Nielsen, Staff

WADSWORTH – A panel of dials, meters and knobs surrounds the beige-colored control room at the South Texas Project, one of two nuclear power plants in Texas.

The displays that light up in bright shades of red and green have a decidedly retro look with nary a digital display in site.

"This is the best the 1970s had to offer," says James Von Suskil, vice president of nuclear oversight for NRG Energy, one of the owners of the plant in Matagorda County 80 miles southwest of Houston. Some components on the control panel are so old that the plant operators look to the auction website eBay for parts.

But the look of the control room belies the fact the South Texas Project – which opened in 1988 – is one of the newest nuclear power plants in the United States.

The nuclear industry hopes that will change – although it faces a number of obstacles.

As cutting carbon emissions becomes a priority for government and business, proponents of the nuclear power sector say their technology is the perfect way to fill a void as coal plants close under the weight of new environmental rules

But they also acknowledge that in the age of cheap natural gas, the economic headwinds might be too strong to allow a nuclear renaissance.

While officials at the South Texas Plant tout the important role of nuclear energy to the country’s energy mix, NRG has shelved plans to help finance the expansion of the facility from two units to four.

"The economics of new nuclear just don’t permit the construction of those units today," NRG spokesman David Knox said.

Nuclear energy provides nearly 20 percent of the nation’s electricity, according to the Nuclear Energy Institute, a trade group.

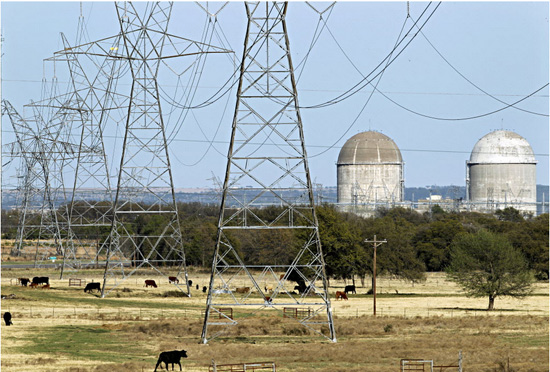

Texas has two nuclear plants – the South Texas Project and the Comanche Peak Nuclear Power Plant in Somervell County southwest of Fort Worth.

Combined, they provide about 12 percent of the state’s electricity- more than comes from solar and wind power combined.

But unlike those other emissions-free sources, nuclear plants almost always operate at or near full capacity, making them part of what the power industry calls the "base load."

While the nuclear power industry has long portrayed itself as a clean source of energy, it’s doubling down on that pitch as it emphasizes the role nuclear can play in meeting the country’s pollution goals. While solar and wind are important, the industry argues, they don’t operate at the same scale or as consistently as nuclear.

"I believe there absolutely is a future for nuclear energy," said Tim Powell, site vice president at the South Texas Project, during a discussion with journalists at the plant Thursday. "Any portfolio of electricity within a state needs a good mix."

The South Texas Project is owned jointly by NRG, Austin Energy, and San Antonio’s CPS Energy, and its federal licenses allow it to operate until at least 2027.

Although NRG shelved plans to help fund two additional units at the facility, it hasn’t halted the ongoing process of requesting permits for them, since it wants to allow the plant to seek another source of funding.

Knox said NRG he expects the government to grant permits for those new units sometime next year.

Whether that will translate into construction is another question, because of a slew of broader factors that nuclear advocates say threaten the future of their industry.

"When I flip the light switch, I don’t give a lot of thought to where the power comes from," said former Indiana Sen. Evan Bayh, co-chair of Nuclear Matters, a group supported by nuclear plant operators.

"But because of the trends and the risk to 20 percent of our electric supply, the public needs to start thinking about this and understanding what the challenges are."

Natural gas provides 27 percent of the country’s electricity and an even bigger share in Texas.

The domestic production boom unleashed an abundance of natural gas that has pushed its price dramatically lower than it was a decade ago, bringing electricity costs down along with it.

That means many nuclear operators have to accept lower prices for their product, despite the higher capital costs of a nuclear plant, which makes the economics of the projects harder to justify.

The industry contends that electric markets don’t price in the economic value of nuclear’s reliable, carbon-free electricity.

"People tend to take these plants for granted," Bayh said. Without a healthy nuclear industry, he argues, it will be nearly impossible for the country to meet its clean air standards.

One way to do that, he and others say, would be to add nuclear power to states’ renewable portfolio standards.

Those rules require electric producers to generate – or buy from other generators – a certain amount of electricity from renewable sources. In Texas and most other states, eligible sources include wind, solar and biomass power, but not nuclear.

"Nuclear is as clean as any of the sources in those programs," said Michael Krancer, a partner at the law firm Blank Rome and former secretary of the Pennsylvania Department of Environmental Protection.

Another hurdle for nuclear power is the largely flat U.S. electricity demand, held down by a sluggish economic recovery and increasing energy efficiency of houses and appliances.

For now at least, the industry struggles to overcome the obstacles.

The U.S. has 61 commercial operating nuclear plants, according to the U.S. Energy Information Administration.

Nuclear plants in Florida, Wisconsin and California closed in 2013, and the Vermont Yankee plant closed last December.

"They’re perfectly healthy plants, and they’re not shutting down because they’re too old," Krancer said. "They’re shutting down from unfair market competition."

Krancer argues that federal tax credits for wind power make it difficult for nuclear to compete on a level playing field in competitive electric markets.

That message falls flat among most environmental advocates. The Sierra Club, for example, says the 2011 Fukushima disaster triggered by an earthquake and tsunami in Japan shows nuclear is still too risky.

And, the organization says, the lack of a long-term federal plan on nuclear waste disposal leaves safety questions unanswered.

The Sierra Club also contends that the billions of dollars it costs to build nuclear reactors would be spent more wisely on developing renewable sources like solar and wind.

The economic hurdles facing nuclear plants are especially acute in Texas and other deregulated electricity markets, said Julien Dumoulin-Smith, a utilities equities analyst at investment bank UBS.

Large-scale nuclear plants may have cost advantages over other generation sources in the long-term, he said. But their large up-front costs and the long lifespan of their assets make the economics of the project risky, especially when power prices are relatively low.

Five nuclear reactors are under construction now at three sites, according to the Nuclear Energy Institute.

Among them is a second unit at the existing Watts Bar nuclear plant in Tennessee, which is likely to come online later this year. It will be the first new commercial reactor in the U.S. since 1996, according to the Tennessee Valley Authority.

The milestone doesn’t impress nuclear opponents.

"Nothing has changed," said John Coequyt, director of the Sierra Club’s federal and international climate campaign.

"All the environmental groups understand: nuclear isn’t a good solution to climate change. It’s too expensive and it’s too slow."

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Judge clears Energy Future to move ahead on selling Oncor to Hunts

September 17, 2015

James Osborne

Dallas Morning News

Transmission lines lead to Luminant’s Comanche Peak Nuclear Power Plant near Glen Rose, Texas. (Tom Fox/The Dallas Morning News)

WILMINGTON, Del. — Almost 18 months after filing for bankruptcy, Texas’ largest power operator Energy Future Holdings was cleared Thursday to move ahead on its plan to break up the company and settle its $40 billion in debts.

With hopes of getting out of court by spring, Energy Future plans to hand its power plants and the retail business TXU Energy to senior creditors, while the transmission business Oncor will be sold to a group led by Dallas billionaire Ray L. Hunt.

It was a quiet conclusion to what had the makings of a potentially high-stakes showdown between Energy Future and an aggressive group of creditors arguing the current restructuring plan is unlikely to succeed. By the time teams of dark-suited attorneys made their way into court Thursday morning though, the two sides had agreed to a temporary truce.

Smaller disagreements would be put aside, leaving the larger question of whether Energy Future was fairly paying off its creditors with what assets it has left to a trial in November.

"We’re happy to cede the battleground today," said Andrew Dietderich, an attorney representing the opposing creditors group. "Our objection is stronger than ever."

The case marks the inglorious end to what remains the largest leveraged buyout in U.S. history. Led by private equity tycoons Henry Kravis and David Bonderman, in 2007 the shareholders of TXU Corp., which served millions of customers across Texas, agreed to sell the company for $45 billion.

But saddled with so much debt, the company quickly fell into financial trouble when natural gas prices — which set the price of electricity in Texas — started to fall, as hydraulic fracturing operations across Texas and Pennsylvania flooded the marketplace with gas.

The entrance to the U.S. Bankruptcy Court in Wilmington, Del. (James Osborne/Staff Writer)

Now every couple weeks attorneys from New York and Dallas file up to the fifth floor of a nondescript red brick building in downtown Wilmington to argue over what’s left of what had been one of Texas’ oldest and most recognizable companies.

One of the busiest courts in the country for corporate bankruptcies, the Delaware district has become like a second home to those who operate in the arcane but lucrative field. Sitting shoulder to shoulder on dark-wooden benches Thursday, attorneys racking up hundreds if not thousands of dollars for the appearance speculated on the day’s developments.

"If everything goes right it could be be done by April, but I don’t know," said Harold Kaplan, a Chicago-based attorney. "Everyone’s still doing staring contests."

The question is whether the deal to sell Oncor, which serves more than 3 million customers across North and West Texas, will go through. Hunt and his partners want to place the power line company into what is termed a real estate investment trust, essentially a means to shift income tax liability from the company to its shareholders.

Only a utility on the scale of Oncor has never been operated under such a structure, tax experts say.

Hunt and his son Hunter, who helps run Hunt Consolidated and launched the power line business Sharyland Utilities in 1999, are counting on Oncor generating enough income to support a purchase price valued between $18 and $19 billion. But first they will need to persuade the Texas Public Utility Commission, which sets rates for the transmission and distribution of electricity.

An application for the takeover of Oncor will be filed within the next two weeks, an attorney representing the Hunt consortium said Thursday.

The fate of Energy Future hinges on the Hunts getting a favorable ruling from the PUC. Without it, the deal would likely collapse and the company and its creditors would have to regroup next year and find an alternative strategy.

"We wanted to stay away from settlement issues. Those are matters for another day, namely Nov. 3 and thereafter," said Marc Kieselstein, an attorney representing Energy Future.

The day was not entirely absent of conflict.

The Office of the U.S. Trustee, which acts as an administrator in federal bankruptcy cases, joined forces with a small creditors group to argue that it was too early for the company to start sending out ballots for creditors to vote on the restructuring plan.

An actual investor in Energy Future – standing out in his sport coat and hiking shoes – took to the podium to say the proposal "doesn’t seem fair."

But Sontchi had seen enough. After closing in on 18 months of hearings and more than 6,000 court filings, he signaled to the attorneys gathered before him it was time to move towards an end.

"A transaction doesn’t have to close, but the possibility of close-ability in a timely fashion – yes, I used the word close-ability – requires action be taken now," he said.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Culberson County Supports Nuclear Waste Plan, Judge Says

June 19, 2015

Hudspeth County Herald

Though he said he is not prepared either to "rubber stamp" the proposal or to "veto it immediately," Culberson County Judge Carlos Urias said Monday (June 15) that he believes a majority of elected officials and county residents support a plan to make the county the destination for the nation’s spent nuclear fuel.

Urias said that he thinks a majority of commissioners would vote to support the radioactive-waste proposal now – but that Culberson County officials remain in an "information-gathering" mode. He said he would likely bring the matter before commissioners in August.

"Being rural, we don’t have too many opportunities for new businesses," Urias said. "There are benefits in terms of jobs and tax revenues. When you mention ‘nuclear’, there are concerns – I understand that.

"It’s a controversial venture," he said, "but if the people of Culberson County support it, I will not hesitate to put it on the agenda and to support it."

Urias’ comments came after a June 11 public meeting in Van Horn – at which the most outspoken of the roughly 80 attendees opposed the nuclear-waste plan. But Urias said that about 50 of those 80 attendees – including most of those who spoke in opposition – were not Culberson County residents. And he said that opposition from non-county residents would not intimidate Culberson County officials or deter them from supporting the project.

"It’s a Culberson County decision," Urias said, "not a Hudspeth or Jeff Davis or Brewster or Reeves County decision."

Urias expressed frustration at news reports – specifically a piece by Midland’s NewsWest9 television – that claimed there was no local support for the proposal. He said those reports were based on comments from non-county residents. Urias said the station had not spoken with him or any of the other Culberson County elected officials, from the City of Van Horn or the school district, who were present at the June 11 meeting and support the project.

The construction in Culberson County of a long-term storage facility for high-level radioactive waste would be a major change in the West Texas landscape – and could pose risks to regional residents far beyond Culberson County. At the June 11 meeting, speakers cited the effects of a potential leak on the environment and human health – and on the possibility of the site being the target of a terrorist attack. Waste would be transported by truck or rail, creating additional risks in the region.

The facility could begin by storing spent fuel from nuclear power plants in Texas – in Somervell and Matagorda counties – but is ultimately planned as the destination for spent fuel from all of the nation’s 100-plus commercial reactors. The spent fuel is some of the most dangerous radioactive waste the country produces.

Waste companies have said that a West Texas facility could be an "interim" storage site for the spent fuel – though that interim could last as long as a century, and the dangers of the waste would continue far longer than that. Opponents note that safety standards can deteriorate over time. They cite the Waste Isolation Pilot Plant, or WIPP, near Carlsbad, N.M. – the facility received high marks for safety after it opened, in the 1990s, but in 2014 was the site of multiple radioactive leaks.

Culberson County is the latest in a list of sites in West Texas and eastern New Mexico that have been proposed for the project. For years, a site in Nevada called Yucca Mountain was planned for the spent fuel. After sustained local opposition, the Yucca Mountain project was effectively abandoned in 2009, and the hunt for a new site began.

In Culberson County, an Austin-based company called Advanced Fuel Cycle Initiative, or AFCI-Texas, proposes to store spent nuclear fuel about 40 miles east of Van Horn – on land 9 miles north of Kent and Interstate 10. AFCI is reportedly negotiating for the purchase of "several thousand acres" of the Apache Ranch from the Dan A. Hughes Company. The Dan A. Hughes Company is a Beeville, Texas-based oil-and-gas company. The Apache Ranch property is just beyond the northern end of the Davis Mountains, and is about 10 miles from both the Jeff Davis and Reeves county lines.

At the June 11 meeting, held at the Karen D. Young Auditorium in Van Horn, AFCI principal Bill Jones described the company’s plan. Nuclear waste would be stored above-ground, in steel canisters encased in concrete. Jones showed diagrams of circles, 150 miles in radius, extending from potential storage sites – showing the area that could be affected in a catastrophic, "worst-case scenario" disaster at the site. Such a disaster would likely involve an attack or explosion, rather than a leak. The affected area would include most of Hudspeth County and much of the Davis Mountains and Big Bend area.

Dr. Sean McDeavitt, a Texas A&M nuclear engineer who said he is not in the employ of AFCI, also spoke at the meeting. He emphasized the security measures that would be in place in the transportation, storage and monitoring of the waste.

AFCI says the project would take six to eight years to complete, and it could be a decade or more before the site received radioactive waste.

AFCI says the project would involve a capital investment of $154 million, tax collections of $10 million a year and the "potential for significant future expansion and development." The company has said that construction of the facility would employ about 180 people, and that about 100 people would be employed to maintain the facility.

The Kent site is not the first West Texas property AFCI has considered for the project. In November 2011, Jones and Humble met with Hudspeth County officials, to discuss a plan to store the waste north of Fort Hancock. Hudspeth officials rejected the proposal.

AFCI also approached the community of Big Spring, in Howard County. And in March 2014, officials in Loving County announced that they had met with AFCI representatives and would welcome the project. The Loving County proposal appeared to have the support of state and federal officials. It is unclear how the project was derailed and why AFCI is now exploring a different site.

There are other proposals to store the high-level waste in the region. Waste Control Specialists operates a radioactive-waste facility in Andrews County, east of Midland, and has applied for a permit to take on the high-level spent fuel. And a coalition of officials in Eddy and Lea counties, in New Mexico, is seeking to bring the waste storage to their area. AFCI representatives have said that if Culberson County does not embrace the project, it could be exposed to the risks of nuclear-waste storage, without any of the benefits.

The approval of Culberson County officials is not a legal prerequisite for AFCI’s project in the county. But after the controversy over the Yucca Mountain plan, the U.S. Department of Energy is pursuing a "bottom-up" approach to finding a storage site for the waste. Federal officials hope to find a community that will invite or support the project. At present, most spent nuclear fuel is kept on-site at reactors – but the federal government has collected fees from nuclear plants for long-term storage, and the company that wins the contract stands to profit from that fund, which totals about $30 billion.

Urias said that the project is not guaranteed to come to Kent – even if county officials vote to support it. But he said that even with the competition, the AFCI principals "seem to be confident" about their odds. Jones served as general counsel to Gov. Rick Perry, and Perry later appointed him to the Texas A&M board of regents and the Texas Parks and Wildlife Commission.

"They seem to have a lot of clout," Urias said.

Dan Hughes, owner of the Apache Ranch, recently served as chairman of the Texas Parks and Wildlife Commission, and he currently serves on the Texas A&M College of Geosciences Advisory Council; Hughes and AFCI’s Jones may have become familiar through their participation with the two institutions. Hughes also sits on the board of the Borderlands Research Institute, at Sul Ross State University.

Urias said that accepting the waste site would come with other benefits for Culberson County. Federal officials would be eager "to sweeten the deal" in any way they could, he said, and federal funding could be made available to construct a new school campus in Van Horn.

"If I wanted to, I could pass it now – but that’s not what I’m here for," Urias said. "We’re looking at the whole picture. It’s not like opening up a Walmart."

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

DOE speaks up on recertification

Thursday, June 18, 2015

By Olivier Uyttebrouck, Journal Staff Writer

Albuquerque Journal

U.S. Department of Energy officials told a public meeting Wednesday that a radiation release last year at the Waste Isolation Pilot Plant should have no bearing on whether the federal Environmental Protection Agency recertifies the long-term performance of the repository.

Russell Patterson, the DOE’s certification compliance manager for WIPP, also said that the agency doesn’t require EPA recertification to resume operations at the low-level radioactive waste repository.

WIPP, a deep geologic repository near Carlsbad, has remained closed since a February 2014 underground fire and a radiation release. Nearly two dozen employees were contaminated with low levels of plutonium and americium. DOE officials have said WIPP could reopen in a limited way by March 2016. Cleanup is expected to cost $500 million.

About 50 people attended a meeting Wednesday at the Albuquerque Embassy Suites when EPA accepted public comment as part of WIPP’s recertification process, which is required every five years.

Don Hancock of the Southwest Research and Information Center, a WIPP watchdog group, contends DOE’s own recovery plan for reopening WIPP calls for the completion of EPA’s recertification review. But Patterson responded that the statement was a mistake and that DOE has authority to reopen the repository without recertification.

Patterson said DOE must show that WIPP will remain safe for 10,000 years after the repository is closed to get EPA recertification.

"No aspect of the fire or the burst drum affect any assumptions used in the long-term performance of the repository," Patterson said. "The ability of the repository to isolate waste for a very long period of time has not been affected."

Jon Edwards, director of the EPA’s radiation protection division, said the New Mexico Environment Department must approve a resumption of operations at WIPP, and that EPA "expects to be part of the process." But Edwards and other EPA officials declined to say whether EPA approval is required to reopen the repository.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.

Georgia Power executives to testify on nuclear plant

May 31, 2015

By RAY HENRY

Savannah Morning News

ATLANTA — Georgia Power executives will face questions this week about the delays and expense of building a new nuclear plant.

Utility regulators in Georgia will begin a new cycle of oversight hearings Tuesday delving into the company’s progress in building two more nuclear reactors at Plant Vogtle in eastern Georgia. Ultimately, the state’s elected regulators on the Public Service Commission must decide whether to give initial approval to Georgia Power’s spending on the project during the six-month period ending Dec. 31.

The facility is one of three nuclear plants under construction in the United States. Georgia Power, which owns a 46 percent stake in the project, originally expected to pay $6.1 billion on its share of construction costs. Delays have pushed that figure upward to $7.5 billion, according to the latest company estimate.

Analysts working for the Public Service Commission predicted in March the cost could reach $8.2 billion or more since Georgia Power would need to buy replacement electricity if its new plant is not operating on time.

The first of its new reactors was supposed to start operating in April 2016, with the second following a year later. Those time periods have already been pushed back about three years.

Georgia Power said earlier this year finishing the nuclear plant is cheaper than halting construction and instead building natural gas-fired plants. While nuclear plants are enormously expensive to build, they produce power relatively cheaply once they start operating and are not affected by swings in fossil fuel prices.

The facility is "an investment in the future and is expected to provide significant long-term fuel savings for our customers over its lifetime," the company said in a February filing.

Still, the nuclear industry has failed to show it can meet schedules or budgets during construction.

Two utility companies in South Carolina, SCANA Corp. and Santee Cooper, have run into similar delays while building reactors of the same design at the Summer nuclear station. Separately, the Tennessee Valley Authority is on the verge of completing a second nuclear reactor at its Watts Bar plant that was first started in the 1970s. The project to revive that partially completed reactor ran about $2 billion over original estimates.

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.