Atomic-Free Japan by April Roils Debate on Reactor Restarts, Blackout Risk

Jan 26, 2012

By Yuriy Humber

Bloomberg News

Japan will lose its last nuclear- generated power in April at the current rate of shutting down reactors for safety checks, cheering opponents of the industry after the Fukushima disaster while adding to concern about potential blackouts and factory shutdowns.

The country has just three of its 54 nuclear reactors producing electricity after one more unit was idled for maintenance today. Another Tokyo Electric Power Co. (9501) unit was shut earlier this week for scheduled checks.

With one exception, no reactors taken off-line since the March 11 disaster have been allowed to restart as they await results of so-called stress tests. The checks began after an earthquake and tsunami caused reactor meltdowns at Tokyo Electric’s Fukushima Dai-Ichi station that led to radiation fallout over an area about half the size of New York City and the evacuation of about 160,000 people.

With public opinion running against restarting reactors, Japan’s becoming free of nuclear power within three months would have a "psychological" effect, according to Yuji Nishiyama, an analyst with Credit Suisse Group AG.

"If we experience a zero-nuclear situation the argument that we don’t need nuclear power anymore will be stronger," Nishiyama said by telephone in Tokyo. "But, at the moment we cannot live without nuclear power. We may not need 50 reactors, but we do need about 10 or 20."

Fossil Fuel Costs

With atomic stations providing about 30 percent of Japan’s electricity before the Fukushima disaster, utilities have been forced to rely more on oil- and gas-fired power plants to make up the difference.

A switch from nuclear to fossil fuels based on average operating rates at atomic plants would require the equivalent of 323 million barrels of oil a year, adding about $34 billion to the country’s import bill, according to Osamu Fujisawa, an ex- Saudi Arabian Oil Co. manager and now an independent energy economist in Tokyo.

Japan relied on imports to meet 81 percent of its net energy needs in 2010, according to the latest data on the World Bank’s website. That compares with 22 percent for the U.S. in the same year and 8 percent for China in 2009, the latest data the bank has.

Japan’s consumption of liquefied natural gas jumped 32 percent in December, while crude oil use increased more than fivefold, according to the Federation of Electric Power Companies data.

Mothballed Plants

"We do have a number of mothballed power plants, but it takes time to restore those generators, sometimes years," Nishiyama said. "And these plants often have low-utilization rates. Some cannot be used at night."

The cost of burning oil to generate power is almost twice that of gas, he said.

Companies including Toyota Motor Corp. (7203) and Panasonic Corp. (6752) escaped power cuts after they were ordered to cut consumption by 15 percent in some areas during last year’s summer when demand peaked. Households were asked to regulate use of air conditioners. The restrictions were lifted as temperatures cooled.

Trade and Industry Minister Yukio Edano said Japan may have no nuclear plants operating this summer and the government is preparing measures to avoid power shortages, the Asahi newspaper reported, citing his comments in an interview. The safety issue is more important than power supply concerns, Edano told the Asahi.

Reactor Closures

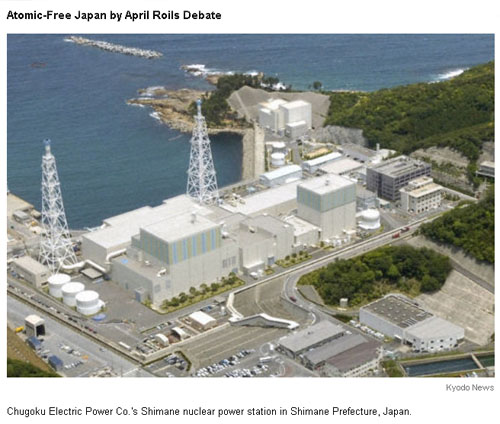

Chugoku Electric Power Co. (9504) shut the No. 2 reactor at its Shimane nuclear station today, leaving 6.4 percent of Japan’s 48,960 megawatts of nuclear capacity on-line. Tokyo Electric’s No. 5 unit at its Kashiwazaki Kariwa station was idled on Jan. 25. The remaining three reactors are due to go off-line for regular checks during the next three months.

Whatever the cost to the utilities, local governments that usually approve a restart of a nuclear reactor have balked. Yuhei Sato, governor of Fukushima, where Tokyo Electric has two nuclear stations including the wrecked Dai-Ichi plant, has vowed to make the region a nuclear-free zone.

Hirohiko Izumida, the governor of Niigata, where Tokyo Electric’s Kashiwazaki Kariwa plant is located, will "never" negotiate with the power utility on restarts until all of the deficiencies exposed by the Fukushima accident are explained and corrected, the governor’s spokesman Takeshi Kumakura said by phone on Jan. 24.

Stress Tests

Tepco, as Tokyo Electric is known, has submitted to the government results of so-called stress tests on the Nos. 1 and 7 reactors at the Kashiwazaki plant, the company said Jan. 16. The tests set up by the Trade and Industry Ministry aim to show how prepared a nuclear plant is to withstand disasters.

Kashiwazaki, the world’s largest nuclear station, has yet to restart three of its seven units since a 2007 quake that led to a radioactive water spill. The work to upgrade Kashiwazaki’s earthquake defenses since 2007 would make it one of the better stations to restart, said Penn Bowers, a utilities analyst with CLSA Asia-Pacific Markets.

"If it didn’t have the Tepco name out there it would probably be on the top of the list for restarts," Bowers said. Kashiwazaki’s units have "been retrofitted to a quake prevention standard that’s probably the best out there."

Reactor Wrangles

Reactor restarts is one of three conditions set by lenders as Tepco negotiates to borrow as much as 2 trillion yen to stay solvent, covering rising fuel costs and compensation claims, two people familiar with the matter said this month. Higher power rates and Tepco accepting a capital injection from a state-run fund are the other two conditions, the people said.

Tepco’s management is resisting giving up control to the state fund even as it faces collapse under the weight of compensation claims and cleanup costs for the disaster. Tepco shares fell 1.4 percent to 210 yen at 12:28 p.m. in Tokyo today. The stock is down about 90 percent since the day before the disaster.

The company owns three nuclear stations. The Fukushima Dai- Ni station, situated close to the Dai-Ichi site, temporarily lost control of its cooling system following the March 11 record earthquake and tsunami. It remains shut down.

Without nuclear reactors, Kansai Electric Power Co. (9503), the main supplier to Japan’s second-largest industrial region, may see demand exceed generation capacity by 9.5 percent in February, the biggest shortfall among suppliers, according to a November assessment released by the government.

Kansai Nightmare

"In Kansai it’s a nightmare," Nishiyama said. "Saving energy is not enough to save the region. We need to think about restarting nuclear power plants more seriously."

Kansai Electric, which serves a region with an economy the size of Mexico’s and has Sharp Corp. and Panasonic factories, is asking customers to voluntarily reduce consumption by more than 10 percent this winter. Kyushu Electric Power Co. (9508) will also be short of capacity after it shutters its last reactor on-line for maintenance, Nishiyama said.

"I think we go to zero before we get restarts," CLSA’s Bowers said, forecasting the first nuclear units to come on-line before summer when power consumption reaches its peak. By summer Kansai may have supplies falling more than 19 percent short of demand, the government has forecast.

"It’s not going to be one switch is flipped and all of them come back on," Bowers said. "Still, if you get a certain amount back on-line you’re not going to have a horrible problem. If you have zero, that leads to a significant economic impact."

To contact the reporter on this story: Yuriy Humber in Tokyo at yhumber(at)bloomberg.net

To contact the editor responsible for this story: Peter Langan at plangan(at)bloomberg.net

This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. SEED Coalition is making this article available in our efforts to advance understanding of ecological sustainability, human rights, economic democracy and social justice issues. We believe that this constitutes a "fair use" of the copyrighted material as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.